A new bill in California is one step away from including undocumented immigrants in a loan program to help Californians buy their first home, drawing praise from some and condemnation from others.

New California Bill

Image Credit: Shutterstock / Freedomz

California lawmakers have advanced a new piece of legislation that could help undocumented immigrants across the state get onto the property ladder, through a state-wide loan program.

Unanimous Approval

Image Credit: Shutterstock / Mircea Moira

Last Thursday Democrats on the California Senate Appropriations Committee unanimously voted to approve AB 1840 which would amend the California Dream For All Shared Appreciation Loan program.

Helping First-Home Buyers

Image Credit: Shutterstock / fizkes

The program, which was launched last year, provides first-home buyers with loan assistance for their down payment or closing costs. Loan amounts could be as high as 20% of the property’s purchase price.

Diversifying Borrower Criteria

Image Credit: Shutterstock / Sheila Fitzgerald

While the 2023 program was only approved for California residents, the state has been looking to expand the diversity of its borrowers. In late June, Gov. Gavin Newsom announced conditional approval of loans for 1,700 first-generation homebuyers too.

Extending Opportunities

Image Credit: Shutterstock / imtmphoto

Now, Democrats want to use AB 1840 to extend that good fortune to undocumented immigrants. If approved, California’s undocumented population would be eligible to apply for their own first-home loans.

“Homeownership Should Be Available to Everyone”

Image Credit: Shutterstock / SaiArLawKa2

“The social and economic benefits of homeownership should be available to everyone. As such, the California Dream for All Program should be available to all,” wrote the bill’s author and Assemblymember Joaquin Arambula, D-Fresno.

Missing Out on Financial Security

Image Credit: Shutterstock / aerogondo2

“When undocumented individuals are excluded from such programs, they miss out on a crucial method of securing financial security and personal stability for themselves and their families,” Arambula continued.

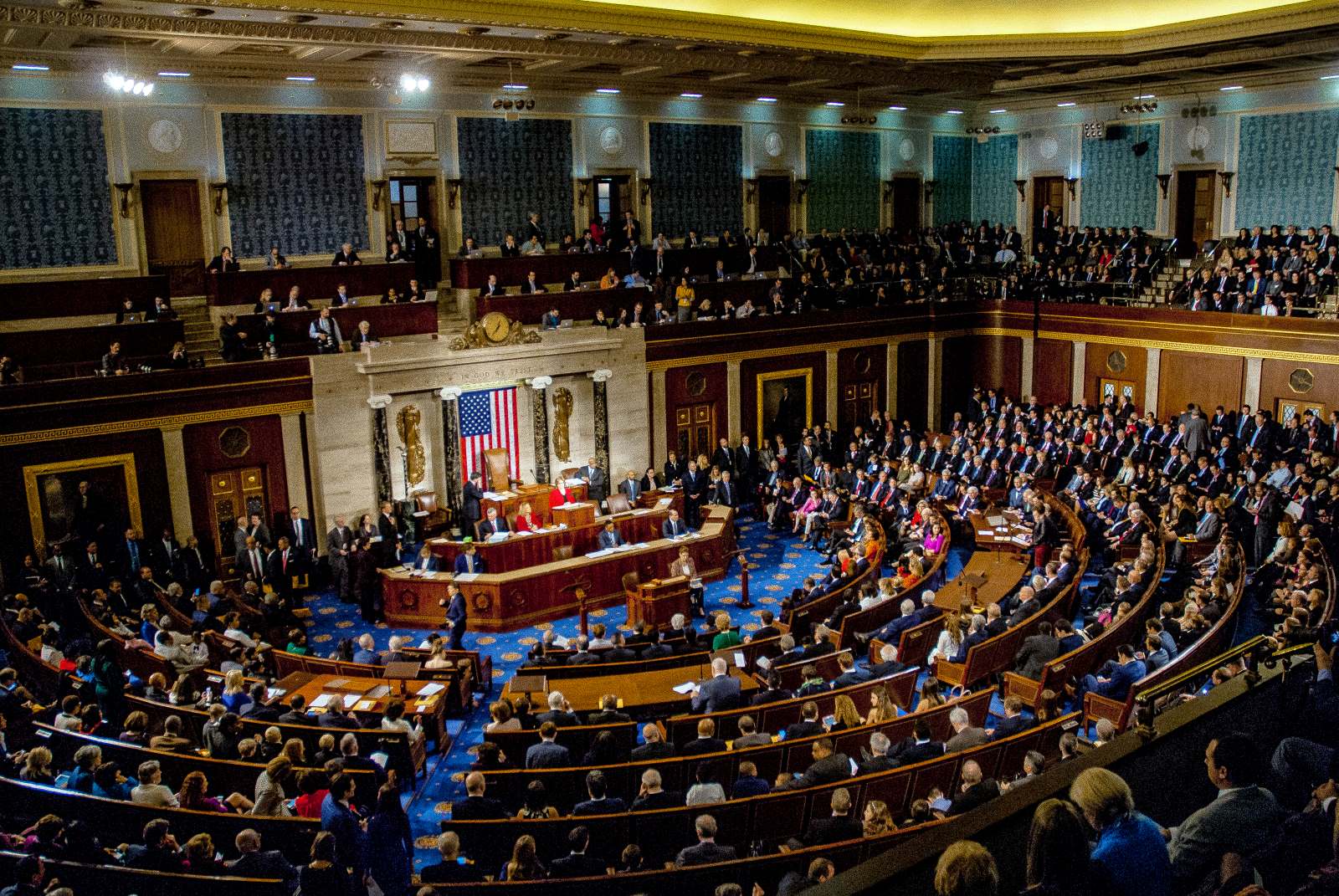

One Final Step

Image Credit: Shutterstock / mark reinstein

The amendment bill has already passed the Assembly and will now be put to vote on the Senate floor. If it passes through the Senate it will be sent to Gov. Newsom for final deliberation.

Criticism from Some

Image Credit: Shutterstock / wellphoto

While the bill has attracted support from Democrat lawmakers and immigration advocacy groups across the state, not everyone is happy. San Diego County Supervisor Jim Desmond slammed the latest decision in a statement to the Daily Caller.

Mixed Up Priorities

Image Credit: Shutterstock / MinskDesign

“Once again, California has chosen to prioritize illegal immigration and fiscal irresponsibility over the needs of its citizens, all while facing a $60 billion deficit that will ultimately be passed onto taxpayers,” Desmond said.

“Dire Financial Straits

Image Credit: Shutterstock / fizkes

“California is in dire financial straits, yet lawmakers continue to prioritize programs that incentivize illegal immigration and strain local resources,” he added.

More Than a Handout

Image Credit: Shutterstock / fizkes

Desmond claims the loan program expansion goes beyond just a “handout” – instead, it’s placing a significant “financial burden onto […] taxpayers.”

“Significant Cost Pressures

Image Credit: Shutterstock / fizkes

His claims aren’t without official precedent, either. While the Appropriations Committee voted to approve the bill, an analysis by the committee did acknowledge that another expansion to the program could create “significant cost pressures.”

Millions in Tax-Payer Dollars

Image Credit: Pexel / Karolina Kaboompics

The cost pressures could be “potentially in the millions annually, to provide additional funding for the Home Purchase Assistance Program to accommodate the expanded eligibility population.”

Repayment Structure

Image Credit: Shutterstock / New Africa

While tax-payer funding is an issue, critics have also pointed out that the “loan” repayments are also focused on when the home is eventually refinanced or sold.

Repayment Expected Upon Sale

Image Credit: Shutterstock / Dragon Images

If the home is sold, the loan holder is expected to repay the full amount alongside 20% of the value increase on the property. However, the loan program is unclear about repayment plans for families who choose to remain in their homes indefinitely.

Other Repayment Requirements Unclear

Image Credit: Shutterstock / goodluz

Since there are no clear arrangements for how long the property can be held before repayments are expected, it’s possible that many of these loans may not be paid back.

Will They Be Repaid?

Image Credit: Shutterstock / Quality Stock Arts

Some are concerned that undocumented immigrant homebuyers will be less able to repay loans obtained through the Dream For All program. According to the economics publication Econofact, the average undocumented immigrant has much less job security and earns 42% less than the average US worker or legally-employed immigrant.

Calls for Restrictions

Image Credit: Shutterstock / Salivanchuk Semen

Others, including El Cajon Mayor Bill Wells, have argued that the Dream For All program should be limited to legal citizens only, because hundreds of thousands of California residents are struggling to afford housing in one of the country’s most expensive states.

“They Should Be First in Line”

Image Credit: Shutterstock / Pormezz

“They should be first in line to buy homes and to get assistance, not people who aren’t from this country,” Wells told CBS8. “I don’t understand why we’re letting people that have lived here all their lives, and sometimes for generations, twist in the wind and not be able to afford their own home.”

Prohibitive Real Estate Prices

Image Credit: Shutterstock / Korawat photo shoot

To purchase an average home in California, potential homebuyers will need to make more than triple the state’s median household income, according to a recent housing affordability analysis from the Legislative Analysts’ Office.

DeSantis in More Hot Water as Florida Floods, Again

Image Credit: Shutterstock / Andrew Cline

Florida residents are struggling this hurricane season, and many are pointing the finger at a certain Governor. DeSantis in More Hot Water as Florida Floods, Again

J.C. Penney’s Closures Signal the End of an Era in Retail

Image Credit: Shutterstock / Jonathan Weiss

Popular department store, J.C. Penney, has announced the closure of multiple stores across the country. This announcement reflects changes in the retail industry as online shopping becomes more popular. But how will these changes affect consumers and the future of in-store shopping? J.C. Penney’s Closures Signal the End of an Era in Retail

Michigan’s Governor Whitmer Lays Down the Law for HOAs

Image Credit: Shutterstock / Gints Ivuskans

Gretchen Whitmer has just taken on HOAs across Michigan. Who won? Michigan’s Governor Whitmer Lays Down the Law for HOAs

Featured Image Credit: Shutterstock / bluestork.

The images used are for illustrative purposes only and may not represent the actual people or places mentioned in the article.